This dimension of the AI index provides the basis for understanding the global landscape of AI and covers general aspects of its composition and geographical distribution, areas of AI specialisation, and AI investments in the EU.

This dimension presents a picture of AI from the economic perspective, focusing on the EU and including international comparison across most indicators. It aims to provide an overview and to frame the other dimensions of the AI Watch Index.

It includes indicators on:

- AI activities, reflecting the size of global AI economic activity, both in absolute terms and relative to the economic weight of countries;

- areas of specialisation in AI, showing the prevalence of AI thematic areas and country specialisation patterns;

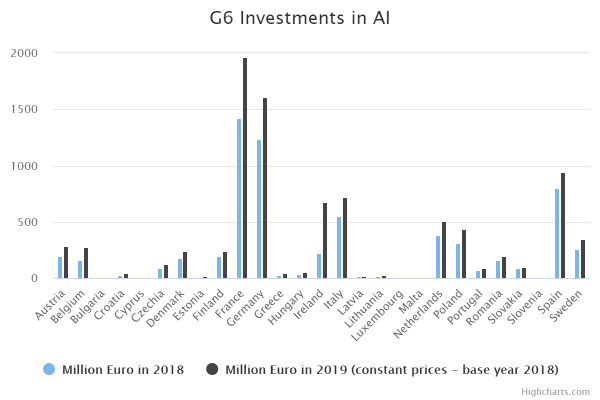

- and AI investments in the EU, which provide information on public and private investments for AI development and implementation in the EU and the Member States

The economic impact of AI has started to spread widely and accelerate over the last 10 years, although the first concepts were initially developed in the 1950s. The technological domain of AI has recently found many economic and social applications and is expected to have even stronger impacts on our daily lives in the future. This analysis and the indicators regarding the global AI landscape provide relevant information about a part of the economy that is not yet specifically addressed by official statistics.[1] Indeed, it is very difficult to collect and discuss statistics, especially with international coverage and comparability, as AI is a cross-cutting technology not adequately captured by existing classifications of products or economic activities. Using the results of an AI Watch report aimed at providing an operational definition of AI to detect and characterise AI-related activities (Samoili et al., 2020, 2021), AI Watch has been able to produce and gather a variety of analyses of AI. These cover multiple perspectives and dimensions of knowledge to deepen our understanding of this important disruptive technology and its impact on the European economy and society.

The EU plays an important role in the global AI landscape, although the absolute number of AI players (i.e., firms, universities, research centres and local governmental institutions that are involved in AI because of the activities that they perform) and its ratio to GDP are not as high as in the US or China. The positive signals regarding the EU AI landscape are: (i) the large number of research institutes active in the field, (ii) the EU’s strong specialisation in the thematic area of AI services, (iii) the high level of competitiveness in robotics and related fields, and (iv) the increasing trend observed in public and private investment across the AI domain. The dynamism of the field of AI in the EU is also reflected in the increasing level of AI investment, as the total of public and private investment in AI increased from 2018 to 2019 in all EU Member States. This investment effort, mostly driven by private investment, leaves the EU in a promising path towards achieving its €20 billion AI investment target by 2025 (Dalla Benetta et al., 2021).

The large number of research institutes active in AI in the EU should allow the EU to maintain a high level of research and development in this area, which is necessary to achieve a leading position in the medium to long term. It is clear that research efforts need to find direct implementations and applications in order to lead to innovations that have a positive impact on society and the economy. In this respect, it should be noted that the EU appears to lag behind other major AI players in terms of patents.

We also see a large number of EU actors in AI service activities. This shows that AI already plays an important role in the EU’s economy and that a variety of AI-based products and services are already marketed. Moreover, robotics is one of the areas of AI where the EU seems to be most competitive. Our analysis shows that this thematic area has strong roots in the EU, as evidenced by: (i) a prominent standing in AutonomousRobotics, one of the most important topics in AI scientific research; and (ii) a strong and highly consistent comparative advantage in the trade (aggregated imports and exports) in industrial robotics – the percentage of the EU’s trade in robotics in all of the EU’s trade is higher than the global average percentage of trade accounted for by robotics, demonstrating the strong competitiveness of the sector in the EU.

A key point for understanding the EU’s positioning in the global AI landscape, and for the assessment of possible future political and economic initiatives, is related to the UK. Indeed, before Brexit, the UK alone accounted for more than half of the players in the EU28 AI landscape. The importance of the field of AI in the UK economy is well known, as demonstrated by the high share of AI players relative to GDP in the UK. Brexit has therefore led, at least in statistical terms, to a considerable downsizing of the EU AI landscape.

Globally, the three major economies that mainly control the AI economy are the US, the EU and China. The United States has become the world leader, with the largest number of AI players[2]. In addition, the US has a relatively high number of AI players per unit of GDP. This indicates that the number of AI players in the US is not only high compared with other geographical areas, but also high relative to the size of its economy.

Our analysis also shows that the US AI landscape is mainly specialised in the thematic areas of AI Services[3] , Audio & Natural Language Processing (NLP)[4], Connected and Automated Vehicles (CAVs) and AutonomousRobotics. These are the AI thematic areas where the US concentrates its AI activity compared with other regions.

China is also home to many AI players, including a relatively large percentage of research institutes. Unlike in the US (and in the EU), relatively few AI activities in China are related to the thematic area of AI Services, suggesting that the level of AI development has not significantly reached the stage of commercialisation of goods and services. Alternatively, the country could be participating at other tiers of the value chain, such as the development of algorithms and parts to be integrated into final products. However, the difficulty of collecting reliable information about economic activities in China may affect international comparability; therefore the deployment of AI Services in China is an issue that should be further investigated.

One of the essential features emerging from the analysis of the AI landscape in China is the strong focus that Chinese players put on patenting activity, as demonstrated by the very high percentage of AI companies that have filed AI-related patent applications. A large number of patents developed in AI by Chinese players concern thematic areas related to the technological development of AI components (such as Automation, the Internet of Everything (IoE), and Machine Learning for Image Processing). This point is further discussed in the AI industry dimension.

Notes

[1] Only very recently has Eurostat started to address the topic, by covering AI uptake in the EU survey on ICT usage and eCommerce in enterprises.

[2] AI players are institutions of different kinds, such as companies, universities, research centres and government institutions, involved in AI-related economic activities.

[3] Economic activities that market AI products and provide AI-based services and applications, including platform infrastructure, software and services.

[4] Includes activities related to the perception, processing, understanding and synthesis of text and audio signals, including speech, by AI systems.

AI Activity

The G1 indicator measures the number of the three types of economic players included in the AI landscape analysis:research institutes, firms and governmental institutions.

The G2 indicator expresses the presence of AI economic players in relation to the size of the economy.

AI areas of strength

AI areas of specialisation: comparative advantage in AI thematic areas

AI thematic hotspots

Comparative advantage in robotics' trade for the EU27