Where does the EU stand in the global AI landscape?

The newly released AI Watch Policy brief answers this question, providing a detailed analysis of the positioning of the EU in comparison to other areas.

The brief is accompanied by a new version of the AI Landscape interactive dashboard, which allows you to explore the AI ecosystem, comparing countries and regions in the evolving AI international industrial and research landscape with respect to players, activities, flows of information and thematic specialisation.

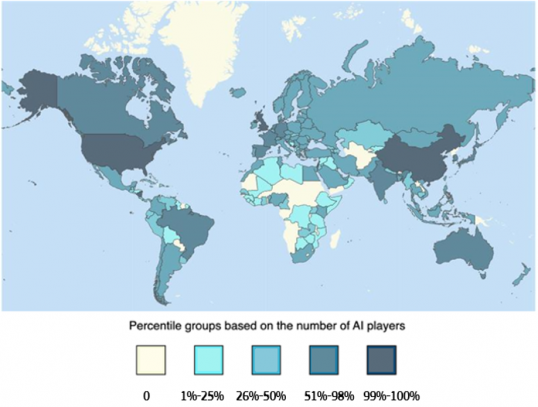

AI Players by country, 2009-2020 (Percentiles of number of players)

The analysis shows the key role of the EU in the global AI landscape, since it is hosting 13% of worldwide AI economic players. This places the EU in third position in the ranking led by the US and with China in second position.

It does so relying on the Techno-Economic Segment (TES) analytical approach, which takes into account information about location, technological aspects and interactions, in order to build a holistic and interconnected view of the worldwide AI landscape from 2009 to 2020.

This methodology allows comparability across countries and over time, resulting in a quantitative analysis that informs policy making with a novel and integrated view of the AI landscape.

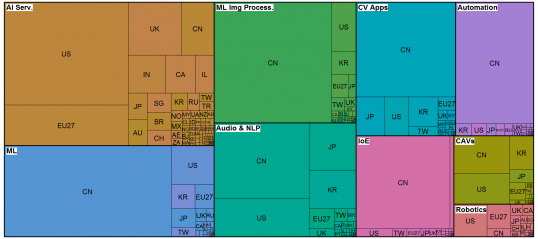

Based on the different types of AI-related activities performed and the description of the firms’ main activity, the analysis identifies nine AI thematic areas or technological subdomains in which AI players are active in the period 2009-2020.

Among those, the EU demonstrates specialisation in Autonomous Robotics and AI Services, showing a higher concentration of activities in these areas than most countries in the world.

Distribution of AI activities by AI thematic area and country, 2009-2020

As outlined in the brief, this suggests that the EU is well positioned to maintain its global leadership and harness the potential of robotics to increase economic competitiveness, sustainability and strategic autonomy.

AI services, on the other hand, use AI technologies to improve the performance of business functions, and therefore have the potential to enable AI uptake among all sectors of the economy. The data collected about the abundance of firms providing AI services in the EU is a promising sign of current and future uptake of AI by EU companies.

Who are AI economic players?

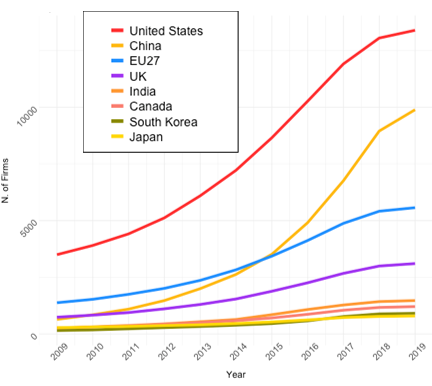

They are defined as firms, research institutes, or governmental institutions involved in AI-related industrial, innovative or research activities. AI firms have a leading role in the AI landscape, representing 94% of players and with all countries having experienced a sharp increase in their number of firms in the last decade.

The US was the first country to enter in the AI landscape and to lead it, while the number of firms in the EU increases consistently but at slower pace.

Firms’ entry year in the AI landscape (top 8 areas), 2009-2020

In fact, Europe’s strength so far concerns more its highest worldwide capacity to generate relevant collaborations and strategic partnerships in R&D, and therefore may act as bridges that interconnect other players in the network.

This constitutes a substantial advantage, since the good average centrality of EU players in R&D networks appears to be a good signal regarding the future resilience of the EU in the AI landscape.

What role for EU funding?

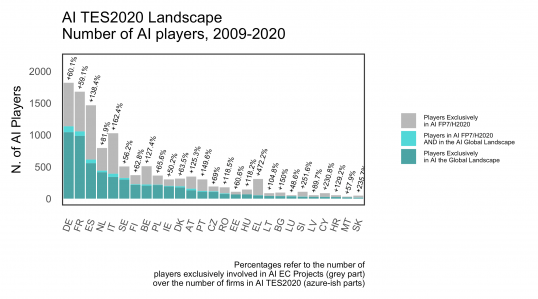

Data shows that funding received from the European Commission under Framework Programmes FP7 and Horizon 2020 has a substantial role in the development of the EU’s strengths in AI. In particular, it has impact on the diversity of AI activity in the EU AI Landscape.

AI Players in EU Member States, 2009-2020

What we can already observe, is that out of the players participating in EC-funded projects, only a small proportion (8%) leave additional trace in the global AI landscape. The analysis of the characteristics and network position of projects’ participants would better clarify their role within the global scene.

However, it is already possible to argue that EC-funded projects capture firms for which AI is not part of the core business, but which may use AI techniques for a specific aspect of their business and develop this within an EC-funded research and innovation project.

Details

- Publication date

- 10 November 2021

- Author

- Joint Research Centre